Dec 13, 2025

RRSP vs TFSA vs FHSA: How to Choose the Right Savings Account in Canada

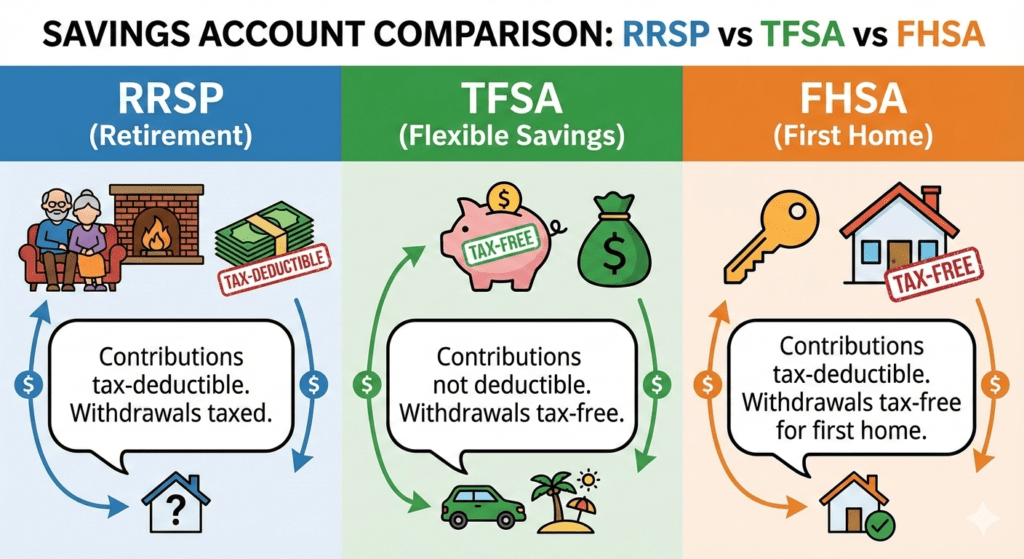

Choosing between an RRSP, TFSA, and FHSA is one of those decisions that looks simple on the surface and quietly controls a large part of your financial future. These accounts are not competitors in a beauty contest; they are tools, each designed for a specific job. If you treat them as interchangeable, you will almost certainly leave tax advantages on the table.

This guide breaks down RRSP vs TFSA vs FHSA in plain language and shows when each one actually makes sense in Canada.

What is an RRSP?

An RRSP (Registered Retirement Savings Plan) is designed primarily for retirement. The defining feature is tax deferral. Contributions are deductible from your taxable income today, which can reduce the tax you owe this year. The money then grows tax-deferred until you withdraw it, usually in retirement.

This structure works best if you expect your income, and therefore your tax rate, to be lower in retirement than it is now. High-income earners often benefit the most. RRSPs also allow employer matching and spousal strategies, which can significantly amplify their value when used correctly.

If your long-term plan includes protecting your family’s future income, it’s worth aligning your RRSP strategy with proper life insurance planning. Many Canadians overlook how closely these decisions interact. You can explore this connection further on the Bonjour Assurance life insurance page.

What is a TFSA?

A TFSA (Tax-Free Savings Account) is about flexibility. Contributions are not tax-deductible, but growth and withdrawals are completely tax-free. This makes the TFSA uniquely powerful for both short-term and long-term goals.

You can use a TFSA for emergency funds, investing, major purchases, or even as a supplemental retirement account. Withdrawals do not affect government benefits and do not count as taxable income. For people with variable income or uncertain future plans, the TFSA often becomes the financial backbone.

TFSA room accumulates every year, even if you do not use it. Misusing this account by treating it like a basic savings account instead of an investment vehicle is one of the most common mistakes Canadians make.

What is an FHSA?

The FHSA (First Home Savings Account) is the newest of the three and is specifically built to help first-time home buyers. It combines features of both the RRSP and TFSA. Contributions are tax-deductible, like an RRSP, and qualified withdrawals for a first home are tax-free, like a TFSA.

There are annual and lifetime contribution limits, and strict eligibility rules. If you qualify and plan to buy your first home within the next several years, ignoring the FHSA is hard to justify. It is one of the most generous tax tools currently available in Canada.

When buying a home, insurance decisions quickly follow. Mortgage protection, property insurance, and income protection all become relevant. Bonjour Assurance covers these topics in detail on its mortgage insurance and home insurance sections.

RRSP vs TFSA vs FHSA: How to Choose

The right choice depends on three variables: your income level, your timeline, and your goal.

If your income is high and retirement is the priority, RRSP contributions usually make sense. If flexibility and tax-free access matter more, the TFSA often wins. If buying your first home is the goal and you are eligible, the FHSA should be high on your list.

The smartest strategy for many people is not choosing one, but sequencing them correctly. For example, an FHSA for home savings, a TFSA for flexibility, and an RRSP for long-term retirement can work together without overlap or waste.

Common Mistakes to Avoid

One common mistake is assuming RRSPs are always better than TFSAs. Another is leaving TFSA contributions in low-interest cash for years. A third is opening an FHSA without a realistic plan to buy a home, which can create unnecessary complexity later.

These accounts are powerful only when they match real-life behavior. Optimizing on paper but ignoring your actual habits is a fast path to disappointment.

Final Thoughts

The RRSP vs TFSA vs FHSA question has no universal answer. Each account solves a different problem. The real skill is understanding what problem you are trying to solve right now, and which tool fits that purpose.

For a deeper dive into the original framework behind these accounts, you can consult the iA Financial Group guide that inspired this discussion.

External reference: https://ia.ca/advice-zone/finances/rrsp-tfsa-fhsa

If you want your savings strategy to work alongside proper risk protection, explore the insurance planning resources available at Bonjour Assurance. Good financial planning is not about picking one product. It is about building a system that survives real life.

More Details