Jan 2, 2026

Wood Heating: Safety, Insurance, and What Homeowners Should Know

When temperatures drop, wood heating becomes an appealing option for many Canadian homeowners. A wood stove or fireplace can create a warm, cozy atmosphere while helping reduce heating costs. But along with comfort comes responsibility. From fire risks to insurance implications, wood heating requires careful planning and informed decisions—especially when it comes to home insurance in Canada.

If you rely on wood heating—or are considering installing it—here’s what you need to know to stay safe, protect your home, and avoid insurance surprises.

Wood Heating and Fire Risk

Heating systems remain one of the leading causes of residential fires in Canada, and wood heating plays a significant role. Chimney fires, in particular, often result from improper use or lack of maintenance. Creosote buildup inside the chimney is a common culprit.

According to fire prevention data published by the Ministère de la Sécurité publique du Québec, heating systems are among the leading causes of residential fires:

Beyond fire hazards, wood heating also releases contaminants such as carbon monoxide (CO) and volatile organic compounds (VOCs). Installing a certified CO detector near sleeping areas and close to the heating system is essential to reduce health risks.

Choosing the Right Wood Heating System

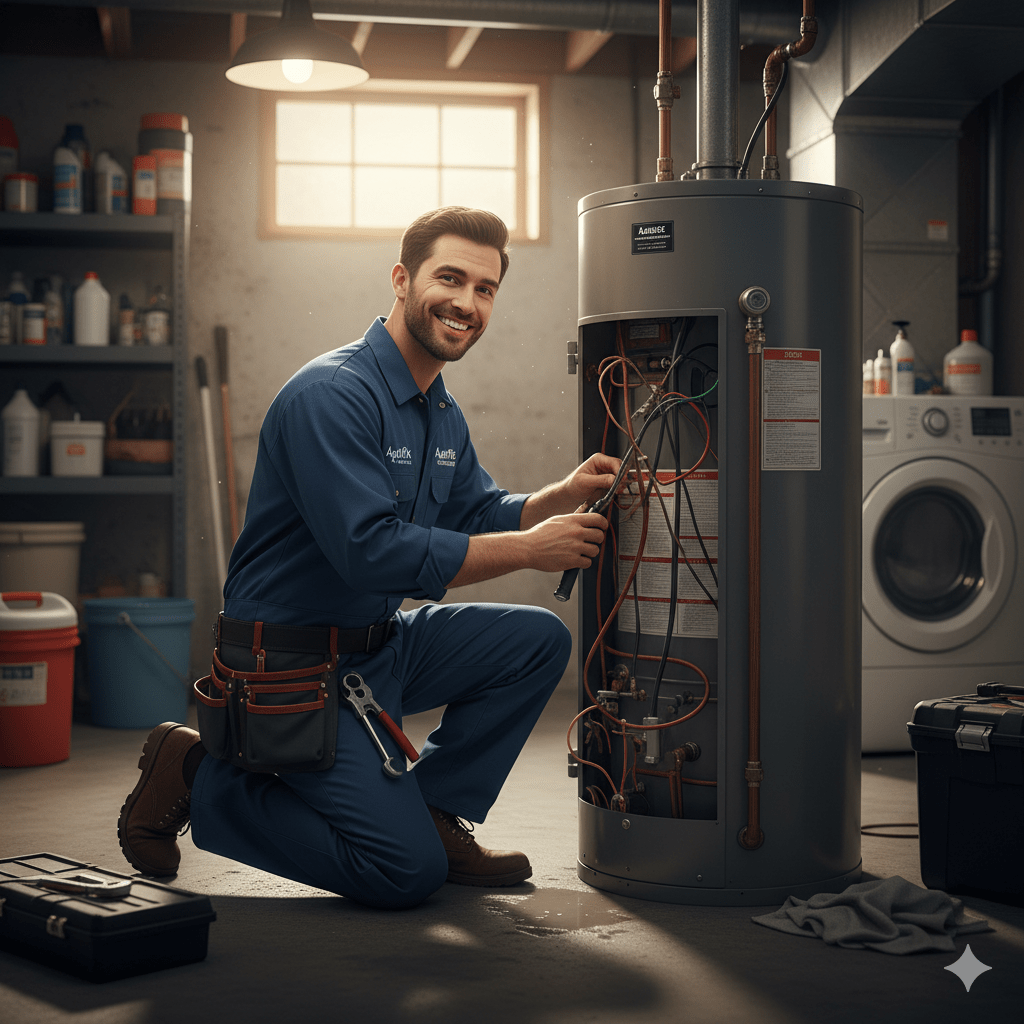

Not all wood stoves or fireplaces are created equal. If you are buying a new system or moving into a home that already has one, professional verification is essential.

A certified expert should inspect both the stove and the chimney to ensure they meet safety standards. Improper installation significantly increases the risk of fire and may also cause issues with your insurance coverage.

Before installing a wood heating system, it’s also critical to check municipal bylaws. Some cities restrict or regulate wood-burning appliances due to environmental and safety concerns.

Simple Ways to Reduce Fire Risk

Wood heating can be safe if used responsibly. Only burn clean, dry, untreated wood. Painted or pressure-treated materials release toxic fumes and damage the chimney flue.

Annual chimney sweeping is strongly recommended to remove creosote buildup. Organizations like the Canada Safety Council emphasize that regular maintenance and proper fuel selection are key to reducing chimney fires. Inside the home, keep flammable objects away from fireplaces and stoves. Firewood should never be stacked next to heat sources, and smoke detectors should always be functional.

Inside the home, keep flammable objects away from fireplaces and stoves. Firewood should never be stacked next to heat sources, and smoke detectors should always be functional.

Safe Firewood Storage Practices

Firewood should be stored outdoors, away from the house. Cover it to protect against rain and snow while allowing airflow for proper drying. Well-seasoned wood burns hotter, cleaner, and produces less creosote.

Only bring small quantities of wood indoors and store them far from fireplaces or stoves. Always follow municipal regulations regarding storage limits and locations.

Handling and Disposing of Hot Ashes

Ashes can remain hot for several days and are a frequent cause of accidental fires. Always place ashes in a metal container with a lid and store it outside on a non-combustible surface.

The container should be at least one meter away from buildings, fences, or vegetation. Never dispose of ashes until you are certain they have completely cooled.

How Wood Heating Affects Home Insurance

If your home has a wood stove or fireplace, you must inform your insurer. Wood heating is associated with a higher fire risk and can directly affect your fire damage insurance coverage.

Failing to disclose a wood heating system may result in reduced coverage or denied claims. Insurers often require proof of professional installation and regular maintenance.

In some cases, the presence of wood heating also influences pricing, as it is considered when determining how home insurance premiums are calculated.

Final Thoughts

Wood heating can be efficient and comforting, but only when safety and insurance considerations are taken seriously. Responsible use, proper maintenance, and transparency with your insurer allow you to enjoy the warmth without unnecessary risk.

If you’re unsure how wood heating affects your coverage, reviewing your policy or requesting a personalized quote can help ensure your home is fully protected before winter begins.

More Details